Operational teams in Financial Crime, Fraud and Compliance are facing multiple challenges in ensuring quick processing of cases. Cases to be actioned have varying complexity, sometimes seeing a 400% difference in end-to-end processing times.

The case type, client type, or tasks within the case are factors that can impact overall E2E time.

Managing operational teams holistically has become increasingly difficult due to challenges in forecasting resourcing and volume of overall cases.

Ensuring that the most appropriate analyst works on a case or task is critical to ensure operational efficiency, and sets you up to manage your operational teams holistically.

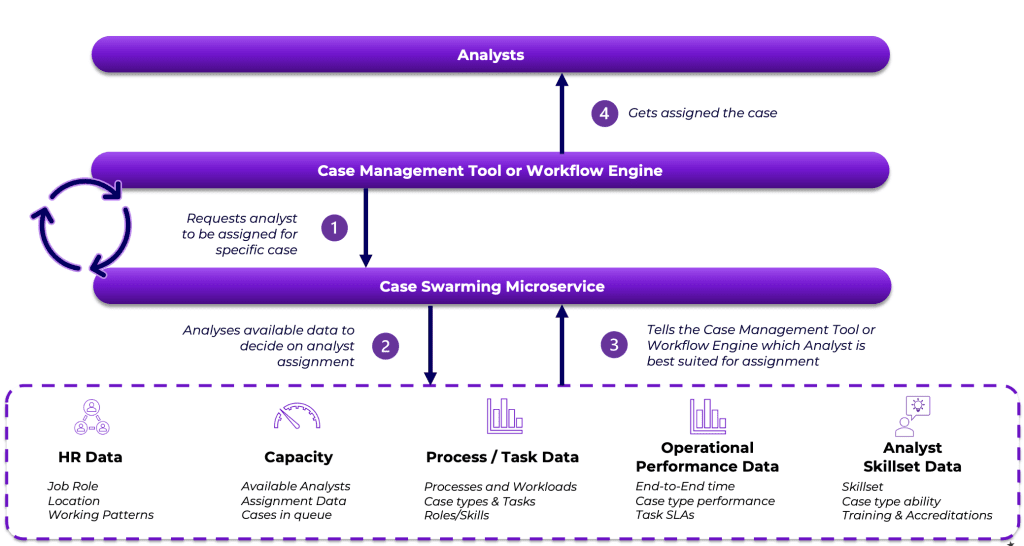

Case Swarming is an operational approach that can bring multiple improvements to end-to-end case time and Fin Crime operational teams. Here’s an overview of how it can work and be applied from a technology perspective:

Case Swarming enables you to unlock and utilise data about your analysts, utilise your teams available capacity appropriately, forecast their utilization accurately, and manage overall end-to-end case time efficiently.

In turn, this creates wider benefits, such as being able to see the impact of process or policy changes on your teams, as you end up having actionable data on tasks, case types, and analysts.

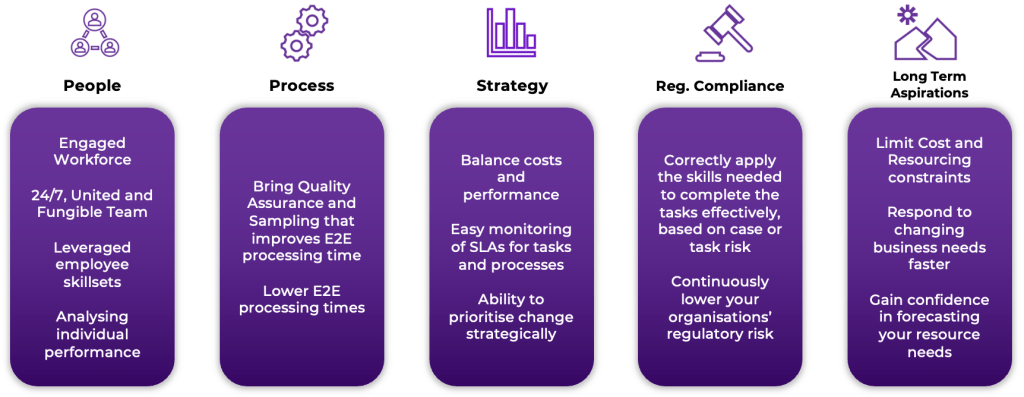

Case Swarming needs to be designed and implemented with an understanding of your organisation’s drivers.

Our Financial Crime and Fraud practice has designed and deployed case swarming solutions in Financial Institutions around the UK, from Tier 1s to Building Societies.

bigsparks’ leading Data and Engineering capabilities means we can help you implement or explore solutions like Case Swarming, no matter your current data and technology landscape.

We have seen these organisations realise the following benefits:

bigspark’s Financial Crime Practice bridges the gap between people, processes, regulations and technology in Financial Institutions.

We have successfully delivered in multiple Banks and FIs:

Our people have strong applied experience in FinCrime and Fraud and are insatiably passionate about solving problems the industry is facing.