In the dynamic world of financial technology, blockchain is not just a buzzword but a revolution, redefining trust, transparency, and transactions. The fusion of data engineering with blockchain in financial platforms is unlocking unprecedented opportunities for innovation, efficiency, and security.

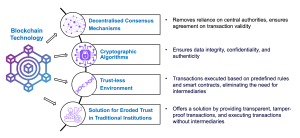

Blockchain technology has emerged as a game-changer in the realm of finance, offering a decentralised and immutable ledger that eliminates the need for intermediaries. By leveraging cryptographic algorithms and decentralised consensus mechanisms, blockchain ensures that transactions are transparent, tamper-proof, and verifiable by all parties involved.

This redefinition of trust is particularly significant in an era where trust in traditional financial institutions has been eroded by incidents of fraud and misconduct. Blockchain provides a solution by creating a trustless environment where transactions are executed based on predefined rules and smart contracts, without the need for intermediaries.

The integration of data engineering principles with blockchain technology is revolutionising financial platforms, paving the way for more efficient and secure systems. Data engineering techniques such as data aggregation, processing, and analysis are combined with blockchain’s decentralised architecture to create robust financial platforms capable of handling large volumes of data securely and efficiently.

This fusion of technologies enhances the scalability, reliability, and performance of financial systems, enabling real-time processing of transactions and data analytics. Moreover, it facilitates seamless integration with existing financial infrastructure, allowing for interoperability between different systems and networks.

In finance, security is non-negotiable. Data engineers leverage blockchain's inherent security features to build impenetrable financial platforms, reducing the risk of fraud and unauthorised access through sophisticated data encryption and secure transaction protocols.

The financial sector demands speed without compromising accuracy. Data engineers optimise blockchain networks for high-speed transaction processing, ensuring real-time updates and settlements, which is crucial for trading platforms, payment gateways, and digital wallets.

Navigating the complex web of financial regulations requires meticulous data management. Data engineers ensure blockchain platforms comply with regulatory standards, implementing mechanisms for transparent and auditable transactions that can withstand scrutiny from regulatory bodies.

The rise of DeFi has opened new avenues for financial services, from lending and borrowing platforms to automated market makers. Data engineers are at the heart of designing and deploying smart contracts that power these services, ensuring they are efficient, reliable, and scalable.

The finance sector thrives on informed decision-making. Data engineers extract and analyse vast amounts of transactional data from blockchain, providing actionable insights for risk management, market trend analysis, and customer behavior prediction, driving strategic financial decisions.

As financial institutions adopt blockchain, the need for interoperable systems becomes crucial. Data engineers develop protocols and APIs that enable seamless communication between traditional banking systems and blockchain-based financial platforms, ensuring a cohesive financial ecosystem.

The integration of blockchain and data engineering in financial technology is unlocking a myriad of innovative opportunities. Smart contracts, for example, are self-executing contracts with the terms of the agreement directly written into code. These contracts automate and enforce the terms of an agreement, eliminating the need for intermediaries and reducing the risk of fraud.

Decentralised finance (DeFi) is another groundbreaking application of blockchain technology, enabling the creation of financial services and products without traditional intermediaries. DeFi platforms leverage blockchain’s decentralised architecture to offer services such as lending, borrowing, and trading directly between users, without the need for banks or financial institutions.

Tokenisation of assets is yet another innovative application of blockchain technology, where real-world assets such as real estate, art, or even stocks are represented as digital tokens on a blockchain. This allows for fractional ownership, increased liquidity, and seamless transfer of assets, revolutionising the way we invest and trade.

The synergy between data engineering and blockchain in the financial sector is not just enhancing current systems but also paving the way for innovative financial solutions that are more inclusive, efficient, and secure.

Let’s be at the forefront of this financial revolution, leveraging our expertise in data engineering to drive forward the blockchain-powered future of finance!